Whats repo means? is a common question among many borrowers. Repo markets provide banks with short-term funding for leveraged positions. During the financial crisis, however, many banks and investors faced collateral requirements that limited the activity of these lenders. Shortfalls in funding forced many investors to reduce their leverage. Consequently, additional asset sales followed, and flight to safety tendencies drove demand for standalone assets. This article will explain the basic concept behind the term “repo.”

A repurchase transaction is a financing transaction involving securities. It is often referred to as a sale-and-repurchase agreement, or a classic repo. In either case, the loan or the securities secured by the repo will transfer ownership. Repo transactions have a high credit risk associated with them, depending on the duration of the loan, the liquidity of the securities, and the strength of the counterparties.

A repurchase agreement is a type of secured lending, in which a buyer sells an asset to a third party with a commitment to purchase it at a later date or on demand. This way, the buyer can sell an asset in order to offset his or her losses, as the asset acts as collateral and thereby reduces the risk of the buyer’s credit. However, repo is not the only way to obtain funds.

As the term implies, the repo market has been a long-standing phenomenon in the financial markets. The Federal Reserve, the central bank responsible for the liquidity of the market, has expanded its operations to an unprecedented extent. Repo operations are a process through which the Fed makes money available to primary dealers in exchange for Treasury securities and government-backed securities. Before the COVID-19 outbreak, the Federal Reserve offered up to $175 billion in overnight repo and $40 billion for two-week repo, respectively. The new expansion was announced on March 12, and the terms have risen to $500 billion for one-month and three-month repos.

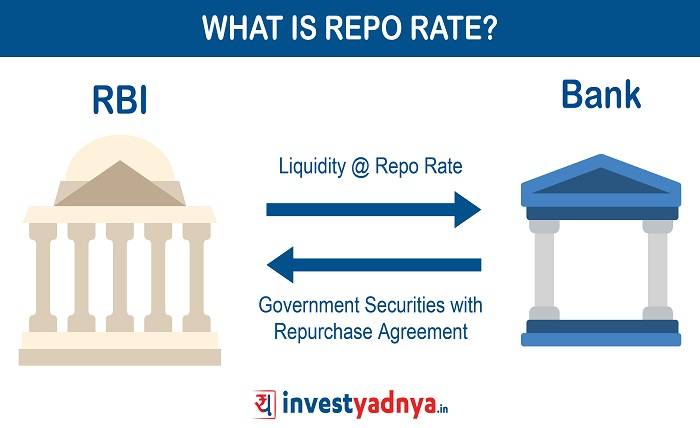

The reverse repo rate is the reverse of the standard repo rate. Inflationary conditions require the RBI to reduce the repo rate, which in turn decreases the amount of money commercial banks can borrow. Consequently, the banks can lend less to the public when the economy is in a tightening situation. However, the reverse repo rate is not the only reason for RBI to raise the reverse repo rate. Inflation and low-interest rates can make this a risky proposition.

As the repo market grows, due bill repo has become less common. This is because collateral is placed in the custody account of the Cash Borrower instead of being held in a neutral third party account. Historically, this method of financing has only been practiced with large financial institutions. The centralized counterparties that were established in the repo market have made this method more cost-effective. There are many advantages to the tri-party repo.